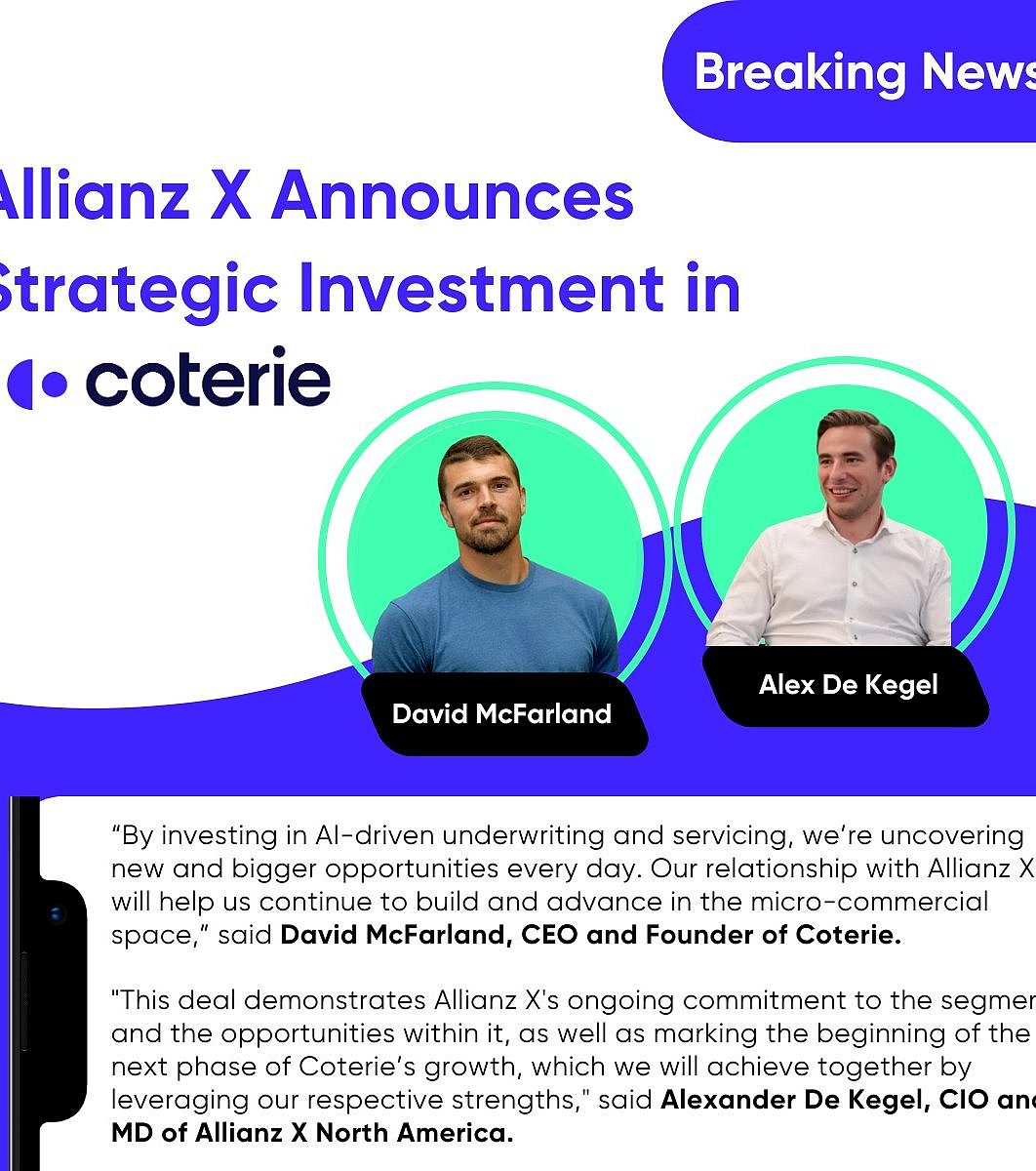

Allianz X is the strategic growth investments arm of Allianz Group, dedicated to keeping the leading global insurer and asset manager at the forefront of the industry.

By making and actively managing high-conviction investments in companies with exceptional growth potential and forging unique partnerships between them and Allianz, Allianz X enables transformative collaborations, builds platforms, and unlocks value for the Group.

Stay connected with Allianz X on Medium, LinkedIn, and X (formerly Twitter).